There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

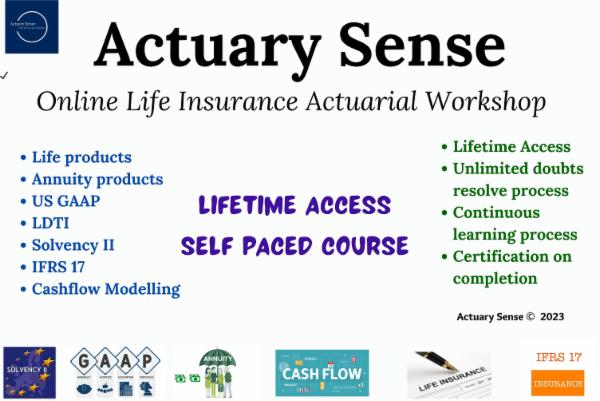

From Theory to Expertise: Learn IFRS 17 - Solvency II - US GAAP - LDTI - Cashflow Modelling

Instructor: Kamal SardanaLanguage: English

Learn the fundamental concepts of Solvency II, IFRS 17, US GAAP and LDTI.

Perform cashflow modelling for term insurance, endowment products. Then we create cashflow model based on different regulation.

Learn by doing with hands-on examples and practical projects that reinforce your learning and build your skills.

This course is designed to cater to both beginners and experienced actuaries who want to learn important industry wide actuarial knowledge.

Understand various life and annuity products from the best in the industry.

Flaunt your skills with course certificates. You can showcase the certificates on LinkedIn with a click.